contra costa county sales tax increase

Finalize recruitment process for new. 31 the last day of the legislative session the California State Senate passed SB1349 authored by Senator Steve Glazer D-7 Orinda to allow Contra Costa County Supervisors to place a half-cent.

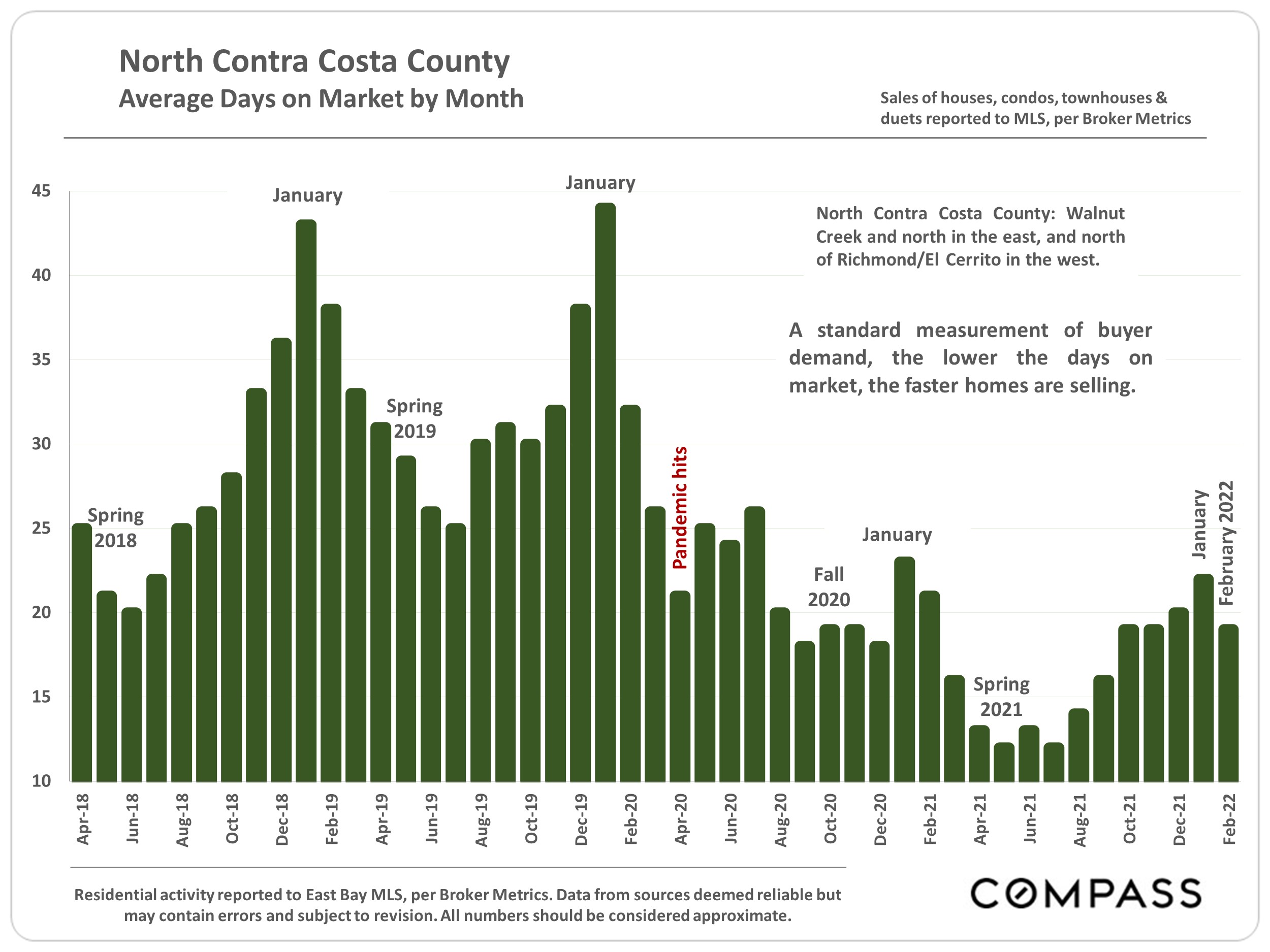

North Contra Costa County Real Estate Compass

The December 2020 total local sales tax rate was 8250.

. Contra Costa sales-tax rates already range from 825 to 975. You may also call our Customer Service Center at 1-800-400-7115 CRS711. And this change asserts the bill itself in Orwellian doublespeak does not constitute a change in but is declaratory.

Look up the current sales and use tax rate by address. The Contra Costa County sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements.

That would bring Contra Costas sales-tax rate up to. California has a 6 sales tax and Contra Costa County collects an additional 025 so the minimum sales tax rate in Contra Costa County is 625 not including any city or special district taxes. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

To review the rules in California visit our state-by-state guide. Countywide pool jumped up 40 a combination of new revenue from out- of-state online retailers due to the enactment of AB147 coupled with bigger online sales due to social distancing and in-store restrictions. Customer service representatives are available to assist you Monday through Friday.

The 2018 United States Supreme Court decision in South Dakota v. Each of the Contra Costa Transportation Authoritys two recent sales-tax-increase campaigns Measure X 2016 and Measure J March 2020 was bankrolled by about 13 Million in contributions made primarily by existing and prospective vendors and contractors to the County with an odor thereby of shakedowns and anticipated kickbacks. January through March were 912 above the first sales period in 2020.

Many Americans in the Bay Area are struggling financially during the pandemic but a majority of voters in Contra Costa County seem to be welcoming tax increases. According to the senate governance finance committee bill analysis the earlier version of the bill that passed the senate the first time would have allowed a possible increase in the countywide sales tax rate to 1175 in cities that already have a 1 sales tax such as in antioch and as high as 1225 in el cerrito which has a 15 city sales. In Concord 51 of voters approved.

Net of aberrations taxable sales for all of Contra Costa County grew 18 over the comparable time period. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net services early childhood services and protection of vulnerable populations thereby increasing the total. Approve Grand Jury report on wildfire preparedness.

The California state sales tax rate is currently. Concord voters will consider Measure V which also would continue and increase an existing. California City County Sales Use Tax Rates.

Home and building projects. Contra Costa County is supposed to use the increased tax to fund essential services including the regional hospital community health centers emergency response safety-net services early. However significant adjustments for delayed payments and other reporting modifications resulted in actual sales that increased 436.

A county-commissioned poll showed at least 59 percent support for the tax depending on various specific inclusions. Webpage and select. Voters in Contra Costa County and three of its cities approved new sales taxes or increases of existing taxes -- tax measures local electeds say.

This table shows the total sales tax rates for all cities and towns in Contra Costa County including all local taxes. The new rates will be displayed on April 1 2021. Contra Costa County voters are considering whether to tax themselves to pay for transportation and the plan accompanying.

Overall place of sale collections grew 403 with most tax groups posting increases. Contra Costa Supervisors move forward placing half-cent sales tax increase on November ballot extend rental eviction moratorium July 16 2020 By Publisher Leave a Comment Andersen only no vote on tax increase measure. County of Contra Costa on April 8 2020 after the March Primary election was decided and the countywide additional half-cent sales tax increase for transportation failed.

Contra Costa County CA Sales Tax Rate The current total local sales tax rate in Contra Costa County CA is 8750. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. A general breakdown of Contra Costa Countys transportation sales tax plan.

By Sam Richards Bay City News Foundation MARTINEZ CA The Contra Costa County Board of Supervisors will proceed with pursuing a half-cent 20-year sales tax measure for Novembers general. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. The Contra Costa County supervisors last month approved spending 10000 for a poll by the firm FM3 Research to help determine voter support for the sales tax measure.

Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years. Note that Sustainable Communities includes money for bike and pedestrian infrastructure community development and Complete Streets pilot projects among others. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine.

The current sales tax in San Pablo is 875. Find a Sales and Use Tax Rate by Address. Support Martizians for Black Lives and mural.

State Senate Bill 1349 passed and signed at the last minute allows the Countys sales-tax cap to increase from 2 effectively to at least 35 or possibly 4 in addition to the States 725 rate.

Register Nevada Sales Tax Nv Reseller Pertmit Nevada Sales Tax Las Vegas Nevada

Election Costs Rise As Contra Costa Supervisors Ok 3 6 Billion 2020 2021 Budget

What Do Your Property Taxes Really Pay For

Job Opportunities Sorted By Job Title Ascending Employment Opportunities Contra Costa Superior Court

Contra Costa County Treasurer Tax Collector Facebook

Sales Taxes How Much What Are They For And Who Raised Them

3 Tips For Increasing Customer Value Davey Krista Increase Customers Creative Small Business Small Business Tips

The San Francisco Bay Area Counties Google Search San Mateo County California Travel San Francisco Bay Area

What You Should Know About Contra Costa County Transfer Tax

No April Fools Joke City Sales Tax Rises To 10 25 April 1 El Cerrito Ca Patch

Contra Costa Labor Cocolabor Twitter

Sales Taxes How Much What Are They For And Who Raised Them

What Do Your Property Taxes Really Pay For

Real Estate Contra Costa Herald

Sales Taxes How Much What Are They For And Who Raised Them